Views: 0 Author: Site Editor Publish Time: 2025-12-06 Origin: Site

Choosing the wrong auto-insertion machine can burn through your budget faster than a misfed tape reel — but choosing the right one can transform your entire SMT line.

If you’re stuck comparing brands, juggling specs, calculating long-term costs, and still feeling stressed about which machine to pick… you’re not alone. Many engineers and buyers spend weeks wrestling with questions like: Which brand is more stable? Is the low-cost option worth it? What about maintenance and spare parts later?

In this guide, I’m going to break everything down for you — performance, cost, reliability, and real after-sales differences — all in one place, so you finally get the clarity you’ve been searching for.

With hundreds of machines on the market, from China’s all-in-one axial insertion models to global players like JUKI, Yamaha, and Panasonic, we’ll walk through the key factors that truly matter and help you make a confident decision without second-guessing yourself.

When selecting an SMT insertion machine, three areas matter most: performance, total cost, and after-sales support. Understanding these core factors helps you compare multiple brands — whether domestic or international — with a clear, objective framework instead of relying on marketing claims.

Performance is often the first benchmark buyers look at, and for good reason. A machine’s capability directly influences production stability and long-term efficiency. When evaluating any SMT insertion machine — whether from China or abroad — focus on these key aspects:

Insertion Speed: Faster isn’t always better. What matters is how stable the speed remains during real production conditions and with mixed component types.

Precision & Accuracy: Consistent placement accuracy reduces defects and rework. Look for stable tolerance performance across thousands of cycles.

Repeatability: A reliable machine should deliver the same result, every shift, every day.

Component Compatibility: Ensure the machine supports your current components — axial, radial, or odd-form — and can adapt to future product changes.

Energy Efficiency & Uptime: Machines designed for smooth recovery, low power consumption, and minimal stoppages contribute to overall line efficiency.

Industry Insight: Modern domestic machines are rapidly adopting advanced vision systems, smarter sensors, and automated error detection — making the performance gap across brands narrower than ever.

Upfront price differences between Chinese and international brands can be significant, but the purchase cost is only one part of the equation. A better comparison comes from analyzing the full lifecycle cost:

Maintenance & Consumables: Factor in the price and availability of spare parts, feeders, belts, and service tools.

Durability & Long-Term Stability: Machines built for heavy-duty or multi-shift production may offer better long-term value even if the initial investment is higher.

Return on Investment: Smaller factories may reach breakeven faster with lower-cost equipment, while large-scale operations may prioritize long-term endurance and high uptime.

Service can be the deciding factor when two machines look equally good on paper. Strong local support often determines how quickly your line recovers during unexpected downtime.

Consider:

Local Service Availability: Quick response times, nearby service teams, and readily available spare parts reduce stoppages and maintenance delays.

Training & Knowledge Transfer: Good suppliers ensure your operators and engineers fully understand machine operation, error handling, and routine maintenance.

Remote Diagnostics & Online Support: Modern insertion machines rely heavily on software. Fast remote troubleshooting can save hours — sometimes days — of unplanned downtime.

In the field of PCB assembly, the all-in-one auto insertion machine is the core equipment for achieving efficient THT (Through-Hole Technology) automation. These machines can handle axial, radial, and odd-form components while supporting mixed SMT/THT lines, helping manufacturers reduce labor costs, improve accuracy, and boost throughput. According to 2025 industry data (Global Growth Insights), the global auto insertion machine market has reached approximately $250 million with a CAGR of about 5%, driven by electric vehicles, 5G, and IoT applications.

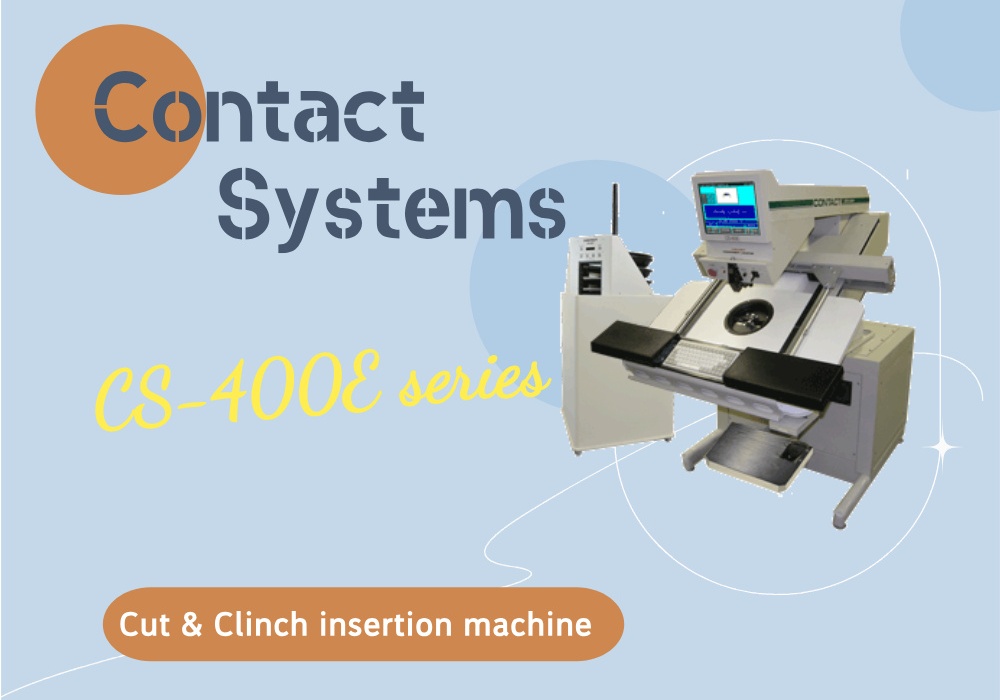

Best known for the CS-400E series, a semi-automatic Cut & Clinch insertion machine designed for axial, radial, and multi-lead THT components. Thousands of units installed worldwide, perfect for prototypes and low-volume production.

Performance: Medium speed (5,000–10,000 CPH with manual assist), accuracy ±0.1 mm, supports inner/outer clinch and micro-cutters, compact footprint (X: 501 mm, Y: 356 mm), suitable for high-mix boards.

Price: Low to mid-range, new machines $50,000–$100,000 (used $20,000–$50,000), excellent value for budget-conscious factories.

After-sales: Strong global network via authorized centers (e.g., Versatec), 1–2 year warranty, 24–48 hour response, readily available spare parts.

Market Positioning: Entry-level semi-automatic segment, targeting high-mix/low-volume EMS providers, emphasizing durability and upgradability.

Application Scenarios: Prototyping, repair stations, low-volume PCBs (consumer electronics prototypes), integrates JIT Bin (708-part capacity).

Industry Feedback: Known as a “workhorse” with 20+ year lifespan; SMTnet users praise reliability, but full automation requires upgrade. NPS ≈ 70/100.

Pros: Extremely durable, quick setup, low maintenance; small footprint.Cons: Relies on manual assistance, slower than fully automatic; not ideal for high-volume runs.

Specializes in I.C.T-A131/ I.C.T-R131/ I.C.T-OFM series, supporting axial (25,000 CPH), radial (20,000+ CPH), and odd-form components (connectors, transformers). Modular design, easy expansion. As the only Chinese brand listed, exports grew 25% in recent years.

Performance: High speed (25,000 CPH), accuracy ±0.05 mm, multi-angle insertion (−90° to +90°), 20+ stations, AI vision, low-maintenance design.

Price: Lowest tier, $30,000–$80,000, 30–50% cheaper than international brands.

After-sales: Factory-direct localized service in China, response <24 hours, 1–3 year warranty, strong global export support (recognized at SMT exhibitions).

Market Positioning: Mid-to-high volume full-automatic segment, targeting cost-sensitive factories transitioning to automation.

Application Scenarios: LED/power modules, mid-volume automotive assembly, easy integration into SMT lines.

Industry Feedback: Widely regarded as the “best value king” (SMTnet/JMW reports), fast delivery, easy maintenance. NPS ≈ 75/100.

Pros: Unbeatable price, highly flexible, full component coverage, ideal for domestic and emerging markets.Cons: Slightly lower brand recognition than international giants; long-term stability in ultra-high-end applications still being proven.

JM-20/ JM-50/ JM100 series are true SMT/THT hybrid machines with 8 nozzles, 15,000–30,000 CPH, AI vision + laser alignment, supporting XL-size PCBs and odd-form parts.

Performance: 15,000–30,000 CPH, accuracy ±0.05 mm, handles components up to 50 mm² / 55 mm height, 3D imaging, infinite feeder options.

Price: Mid-to-high range, $150,000–$300,000, fast ROI (70% labor savings).

After-sales: Extensive global network, 2-year warranty, <48-hour response, comprehensive training from JUKI Americas/Europe/Asia.

Market Positioning: Mid-to-high-mix hybrid segment, leader in automation transition.

Application Scenarios: Automotive/consumer electronics mixed lines, 5G/industrial control boards, high odd-form volume.

Industry Feedback: 15–20% global share (Valuates Reports), praised for innovation at SMT shows. NPS ≈ 85/100.

Pros: Outstanding hybrid flexibility, AI precision, excellent ROI.Cons: Higher price, steeper learning curve for new users.

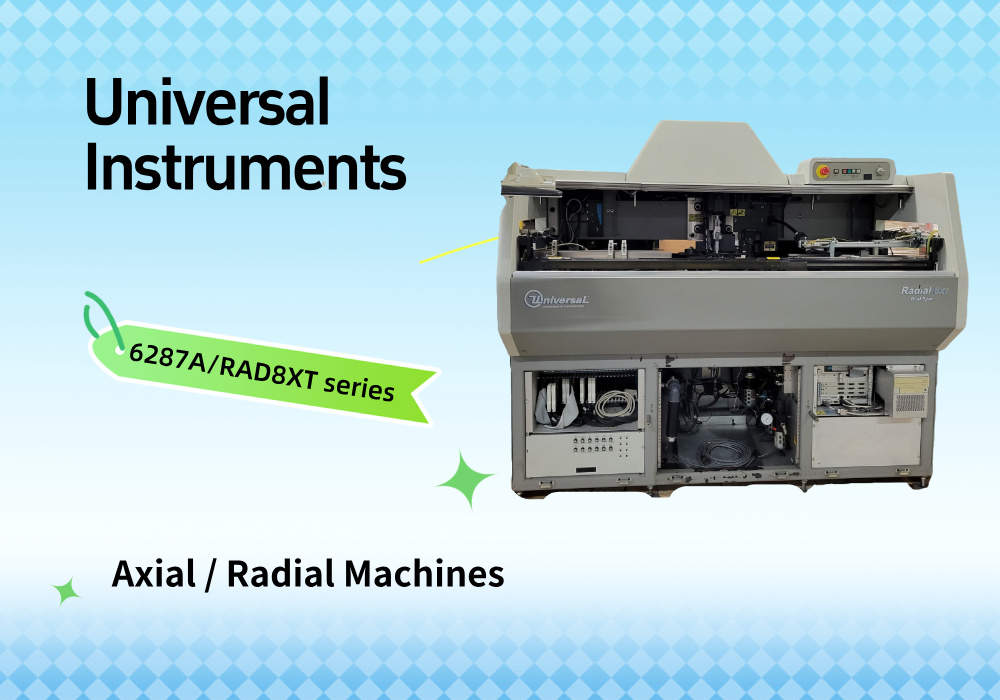

6287A/RAD8XT series are high-speed axial/radial machines with wide lead-span compatibility (2.5–15 mm), huge global installed base.

Performance: 20,000–25,000 CPH, accuracy ±0.05 mm, force monitoring, odd-form expandable.

Price: Mid-to-high, $120,000–$250,000, strong long-term value.

After-sales: North America-centric but global parts supply, 2–3 year warranty, 24-hour response.

Market Positioning: Large-scale precision automation for consumer/auto EMS.

Application Scenarios: High-volume consumer electronics and automotive PCBs.

Industry Feedback: Extremely stable output, though older models need careful maintenance. NPS ≈ 80/100.

Pros: High throughput, excellent compatibility, proven in large factories.Cons: Less flexible than JUKI; upgrade costs for legacy machines can be high.

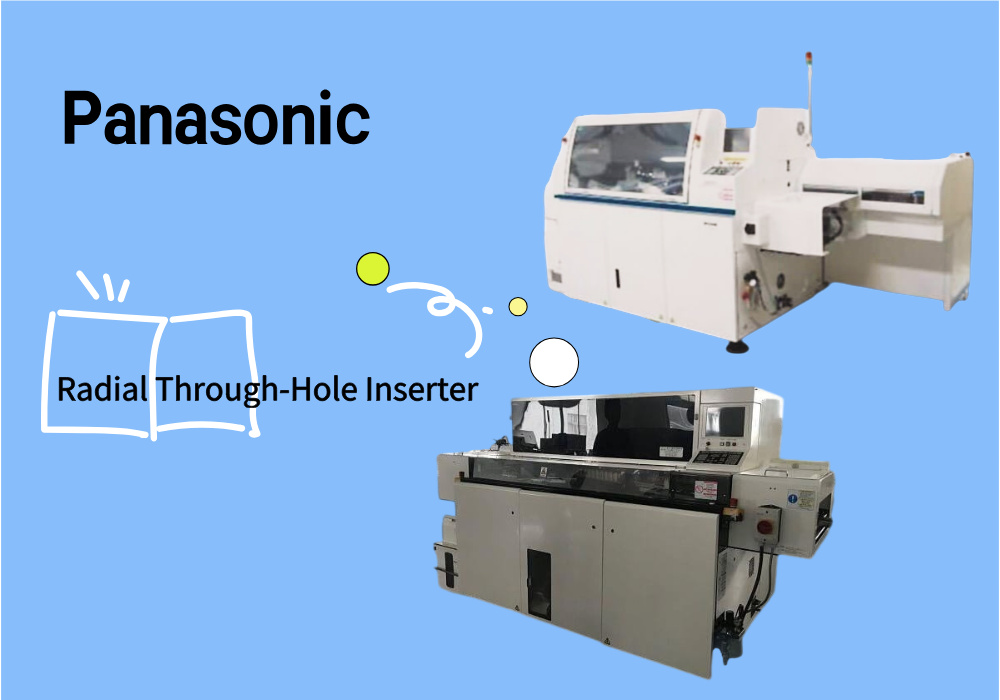

AVK3/RH6 series deliver the highest throughput (up to 30,000 CPH), intelligent detection, and the largest global installed base.

Performance: 30,000 CPH, accuracy ±0.03 mm, guide-pin design, force monitoring, tape & odd-form capable.

Price: Premium tier, $200,000–$400,000, but delivers the highest cost-per-insertion savings.

After-sales: Industry-best global network, 3-year warranty, <24-hour response, full-line support via Panasonic Connect.

Market Positioning: Top-tier modular automation for mission-critical applications.

Application Scenarios: Industrial/medical high-volume, EV/5G core boards.

Industry Feedback: Highest reliability and energy efficiency (MarketsandMarkets leader). NPS ≈ 90/100.

Pros: Unmatched speed, reliability, and integration.Cons: Highest upfront cost; overkill for low-volume shops.

Emerging Chinese brands offer competitive performance at lower costs, focusing on affordability for entry-level markets while gradually improving features for higher-end use.

Global brands often lead in speed, precision, and automation.

Chinese machines are improving quickly, with vision-assisted placement and real-time error detection.

For complex high-volume lines, international machines maintain an edge, while Chinese options are sufficient for medium-volume or cost-sensitive production.

Chinese models: 30–50% cheaper upfront, fast ROI for small/medium factories.

International models: higher cost but potentially lower long-term maintenance and downtime.

Decision depends on production volume, budget, and required precision.

Chinese brands excel with local service in Asia, rapid spare parts, and quick response.

Global brands offer wide coverage but may have shipping delays for parts outside major markets.

Training, remote support, and diagnostic tools are critical factors for smooth operation.

Chinese machines deliver quicker payback for smaller lines, improving cost efficiency.

International machines provide higher throughput, lower defect rates, and more consistent uptime for high-volume production.

Best Fit for Small-to-Medium EMS Clients — If you are an EMS provider with moderate order volume, limited budget, and want to get ROI quickly: a domestically produced machine like I.C.T is often the most cost‑efficient choice. It gives acceptable insertion stability, reasonable accuracy, and lowest upfront cost.

When to Consider Global / High‑End Brands — Once your production volume crosses a certain threshold (e.g. a steady workload requiring placement of tens of thousands of components per shift), or when your products demand high placement precision (e.g. fine‑pitch components, tight assembly tolerances), or when you need very stable throughput for high-mix or long-term production planning — that’s when investing in a global / premium brand machine makes sense.

Key Thresholds for Decision Making

Precision needs: For typical consumer electronics boards, placement accuracy around ±0.05 mm is often sufficient; for high‑density / fine‑pitch or high-reliability devices, target machines with precision ±0.03–±0.02 mm (20–30 µm) or better.

Throughput needs: For medium-volume lines, a machine capable of around 15,000–30,000 components/hour may be enough; for large-volume or mass-production lines, especially with large batch sizes or high run-rate, machines delivering 50,000+ CPH (or with head‑count for parallel placement) show clear productivity gains.

Other Key Considerations — Evaluate not only purchase price, but also total cost over time: maintenance availability, spare parts supply, service support, downtime risk. Also consider flexibility: can the machine handle mixed component types, frequent changeovers, or future product variations.

Practical Recommendation Logic

If your customer orders are small-to-medium, projects do not require ultra‑fine pitch, and you care about cost control and fast ROI → go with a reliable domestic solution like I.C.T.

If your orders are large-scale, or you foresee growth in volume, or your products require high precision / reliability / mixed complex components → prioritize an international / premium brand insertion machine to ensure long-term stability, yield, and scalability.

Discover which insertion machine fits your production volume, precision needs, and budget.

Request your personalized consultation now!

International brands provide higher speed (up to 25,000 CPH) and precision (±0.05mm). Chinese machines are catching up with reliable placement and vision-assisted systems, ideal for medium-volume production.

Entry-level Chinese machines are 30–50% cheaper than global models. High-end international machines cost more upfront but save on long-term maintenance and downtime.

Evaluate local service availability, spare parts delivery, training programs, and remote diagnostics. Fast local support minimizes downtime for Chinese machines; international brands may have longer shipping but extensive global coverage.

I.C.T Auto Insertion Machines are ideal for small factories or startups due to affordability, customizable options, and reliable local support.

Positive feedback on reliability, uptime, and support heavily influences purchasing decisions, especially for long-term investments.

Yes, they can perform well with upgrades such as faster feeders or advanced vision systems. For top-tier precision in very high-volume production, international machines remain preferable.

content is empty!